Employees & Contractors

Select the dropdown manu [employees] from your company name toolbar to add/remove/update your emmployees/contractors

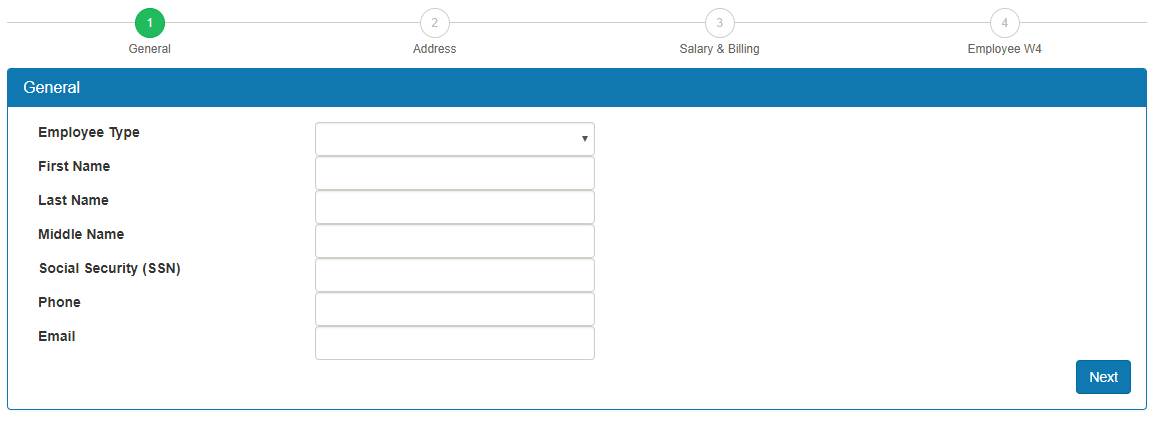

General

-

Select a employee type

Employee: For all regular W2 employees. Payroll taxes will be withhold for all employees

Employee Officer: For all regular W2 company officers. Payroll taxes will be withhold for all company officers.

Contractors: For all 1099 contractors. Payroll taxes will not be withhold for contractors. Signed Federal W9 form is required for all contractors for your own record.

- First, last name, and social security number are required.

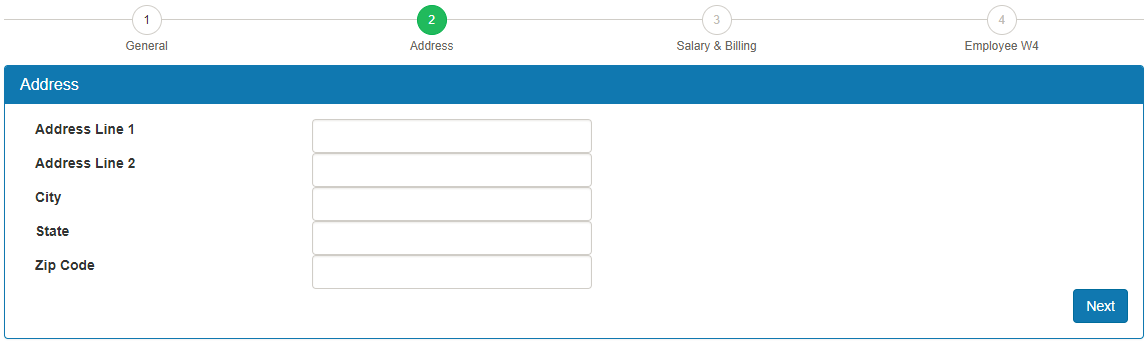

Address

- Address Line 1, City, State, and Zip code are required

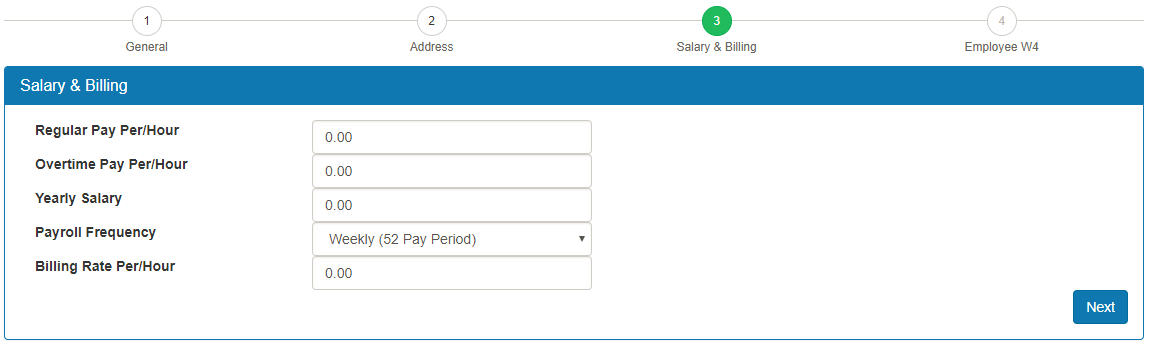

Salary & Billing

- Regular Pay/Per Hour is required for all hourly employes and contractors.

- Over time Pay/Per Hours is for over time pay. Not used in current release.

- Yearly Salary is required for all yearly employees or employee officers.

- Payroll Frequency is the number of pay period in a year for all yearly employees or officers.

- Billing Rate/Hour will be used to invoice company's customers.

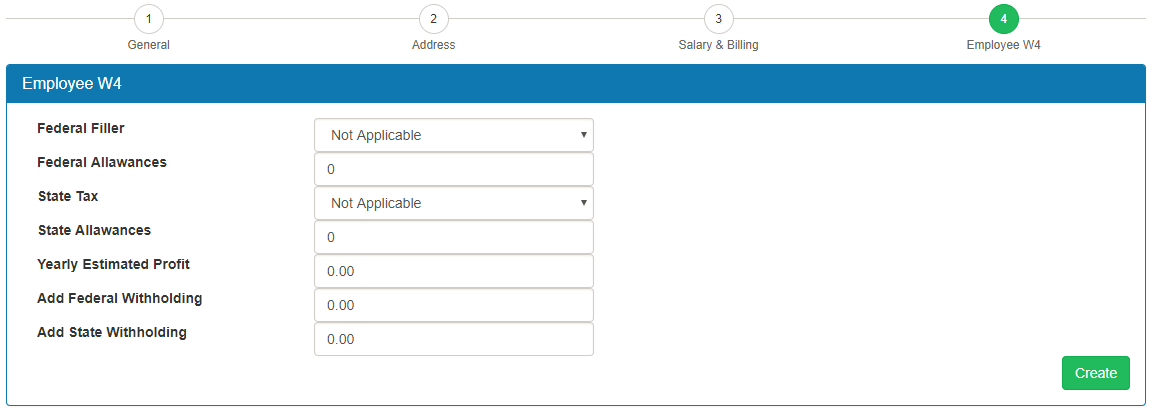

Employees W4

- Select a Federal Filler status from W4 form to withhold federal taxes.

- Enter a Federal allawances if claimed on W4 form.

- Select a employee state tax state to withhold state tax. Select NA for state tax exempt employees.

- Enter a number of State allawances if claimed.

- Yearly Estimated Profit will be used to withhold additional federal tax for officers. (will eliminate to pay federal and state estimated tax payment)

- Enter Additional Federal Tax to be withhold if claimed on W4 form. (Not used in current version)

- Enter Addional State Tax to be withhhold if claimed.(Not used in current version)